This post first appeared on 8percentpa.substack.com

Healthcare has always been a strong return generating sector and has consistently beaten the broader stock market. According to data from the S&P 500 Health Care Index and the S&P 500 Index, the healthcare sector has outperformed from May 2001 to May 2021. with an annualized total return of 12.1%, which was higher than S&P 500's annualized total return of 7.4% during the twenty year period.

I have monitored Roche for a couple of years and admired its strong cashflow compounding and drug innovation prowess. In the last twelve months though, the share price underperformed on the back of the dismal outlook of European stocks and Roche’s lack of growth as it faced declining revenue from the fallout of COVID-19 related sales. As such, share price corrected from CHF400 to CHF240 today, a c40% drawdown. This presents an interesting opportunity to buy the stock today.

At USD320bn, Roche was the largest European pharmaceutical company by market cap when Visual Capitalist charted the above. Today, it is #2 behind Novo Nordisk (market cap >USD400bn) with its market cap USD220bn as of Oct 2023. That said, Roche is consistently ranked top 5 globally in the pharmaceutical space either by revenue or earnings. As per previous ideas, we shall discuss its investment thesis, moats, risks and valuation in detail today.

1. Investment Thesis

Founded in 1896, Roche is one of the oldest pharmaceutical company around with strong innovative roots and was the pioneer in tranquilizers, antiviral drugs and cancer treatment or in today’s terminology - oncology. Fast forward to the 2000s, it made a series of good acquisitions and has now grown into a Swiss multi-national healthcare giant with two core divisions: Pharmaceutical and Diagnostics.

Roche’s investment thesis is predicated on the following:

1. Diversified portfolio of strong innovative drugs: Roche has built a robust portfolio of innovative drugs in oncology, immunology, and neuroscience. On top of that, the company also has strong research and development (R&D) capabilities which has regularly churned out blockbuster drugs such as Avastin and Tamiflu.

2. Leading position in diagnostics: Roche is a market leader in the diagnostics industry with a wide range of products that are used in laboratories worldwide. This business consistently generate c.20% of overall EBIT over the last decade.

3. Roche is a free cashflow generating machine: In 2000, Roche generated c.CHF1.5bn in FCF. It has steadily compounded that and today’s FCF is 10x of that. Its dividend shows the same story.

As usual, we also have Roche's simple financials and ratios below:

Simple financials (Dec 2023, USD)

- Sales: 66.9bn

EBITDA: 25.6bn

- Net income: 15.0bn

- FCF: 16.5bn

- Debt: 18.2bn,

- Mkt Cap 218.5bn

Ratios

- ROE 47.3%, ROIC 24.4%

- FCF yield 6.2% (consistently at mid to high single digit)

- EV/EBITDA 8.9x (Dec 24)

- PER 11.7x (Dec 24), PBR 4.6x (current)

- Past margins: OPM 25-35%

Roche’s numbers could be the strongest we have seen so far in the past few ideas. This corroborates with what we discussed earlier: the healthcare sector has consistently outperformed the broader market and this is because it enjoys stronger margins and return profiles due to the nature of its business. With ROE and ROIC above 20%, but PER at just teens, it simply shouts cheap!

The numbers in the simple financials are translated into USD for easy reference. But Roche actual disclosure in Swiss Franc (CHF) is actually super transparent and it breaks down its businesses in detail for whoever is interested to dig. The slides above give the high level picture while its latest annual presentation materials contained 200 more pages in the link below:

https://assets.cwp.roche.com/f/126832/x/5738a7538b/irp230202.pdf

M&A

Roche has had a long history of M&A that accelerated in the 2000-2010s and made the company what it is today. In the earlier years, one of the more important acquisition was that of Biomedical Reference Laboratories in 1982. This acquisition helped built the foundation of Roche’s diagnostics business in the US.

In 2002, Roche bought a stake in Japanese pharma company Chugai and raised its stake to c.60% in 2008. The overall amount that Roche paid was c.USD2bn but its stake today is worth c.USD30bn, making Chugai one of its is most successful purchases.

Thereafter, Roche made a series of important M&As:

- Ventana Medical Systems for USD3.4bn in 2008, which further strengthened its diagostics business.

- Genentech for USD46.8bn in 2009, Roche’s largest acquisition ever. Genentech is considered to be the first biotech company.

- InterMune for USD8.3bn and Seragon Pharmaceutical for USD1.7bn in 2014, both biotech companies focusing on orphan diseases and cancer treatments respectively.

- Spark Therapeutics for USD4.8bn in 2019, a US based gene therapy company.

These successful bolt-on acquisitions strengthen the company, allowing them to gain market share and receive new technologies, talent and knowhow. The company is also very smart in the way they do it. For both Chugai and Genentech, Roche started with a small stake to know the partner better before acquiring more, thereby ensuring that the integration will be smoother. Roche’s prowess in M&A became its weapon to both beat the competition and absorb smaller competitors for its own benefit.

2. Business Moats

As a pharmaceutical company, Roche enjoys a few moats not available to normal companies. The most important of which is patent protection. Pharma companies are in the business of discovering new drugs and when they do, they file patents and enjoy good economics for 15-20 years to sell these drugs profitably. In fact some companies exploited this and charged an arm and a leg for orphan drugs which led to other issues. But the bottomline is that patent protected drugs make money and Roche has 15-20 of these blockbuster drugs across oncology (cancer), immunology, infectious diseases and other segments at any one time.

That’s Roche’s first moat - patent protection.

The second moat is its R&D engine combined with scale and results. As mentioned, Roche has consistently churned out blockbuster drugs and looks like it will continue to do so. R&D alone is pretty worthless but with scale, it becomes a huge barrier to entry. Roche spends more USD10bn on R&D every year and there are only a handful of companies that match that. The following list comes from chatGPT:

Based on cutoff in September 2021, the following are some of the top pharmaceutical companies known for their significant research and development (R&D) budgets, based on their reported spending in USD. Please note that rankings and budgets may have changed since then:

- Johnson & Johnson: R&D budget of approximately $12.2 billion (2019).

- Pfizer Inc.: R&D budget of approximately $8.1 billion (2020).

- Roche Holdings: R&D budget of approximately $11.4 billion (2020).

- Novartis International AG: R&D budget of approximately $10.5 billion (2020).

- Merck & Co., Inc.: R&D budget of approximately $11.3 billion (2020).

- Sanofi SA: R&D budget of approximately $7.9 billion (2020).

- AstraZeneca PLC: R&D budget of approximately $6.6 billion (2020).

- GlaxoSmithKline PLC: R&D budget of approximately $5.1 billion (2020).

- Eli Lilly and Company: R&D budget of approximately $6.0 billion (2020).

- Bristol-Myers Squibb: R&D budget of approximately $5.9 billion (2020).

ChatGPT is awesome!

R&D dollars are table stakes in the world of pharmaceuticals. If you cannot cough up a few billion dollars to do research in finding new drugs, there is no business to talk about. Naturally, the bigger the budget means more research being done, more money to hire better talent and higher chances of finding blockbuster drugs. With the second highest spending and more than twice as big as #8 (GSK) and below, Roche is playing in the big boys league.

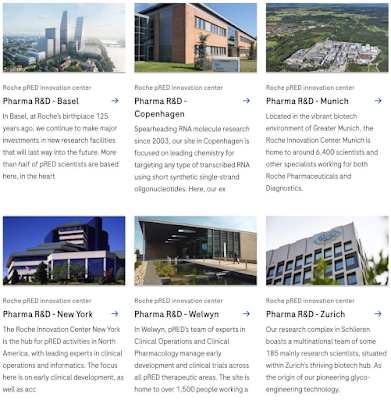

Besides being big, Roche’s labs were also efficient and were able to continue to churn out new drugs and allowed the firm to manage patent expirations very well. This proved that its R&D dollars were well spent, there are always results to show for and that attracts the best scientists to work for Roche and ensure that their labs continue to be successful. They even have the best R&D labs (pic below)!

With good R&D and clout in the Pharmaworld, Roche has also built an eco-system of doctors, drug specialists and medical reps who helped it distribute its drugs efficiently across the globe. This is an intricate system that takes years to build and nurture. When a key drug goes off patent, generics can come in but Roche is able to combine its off-patent drug with another drug and keep selling the combination to doctors who would recommend it to patients, thereby delaying generics from gaining market share quickly.

This is the same moat as the distribution network that large FMCG companies like Pepsi has. It is not easy to replicate. With such moats, it is no wonder that Roche enjoys double digits margins and ROICs. But what are the risks? Every investment comes with risk and no matter how good things look, there is always an Achilles’ heel somewhere. Just like how every superhero has his or her nemesis and Superman has to deal with Kryptonite.

3. Risks

Stagnation

At Roche’s current juggernaut USD220bn in market cap, it gets harder and harder to grow and the company’s recent no.s are showing that. There is no meaningful growth over the last few years despite the supposed boost from the pandemic. Roche provided those ART test kits we used and a slew of diagnostics related to COVID-19 but that was offset by patent expirations and at the corporate level, we are just seeing the modest growth as shown below.

Lawsuits and regulatory risks

Pharmaceutical companies are prone to being sued and Roche had its fair share of lawsuits over the years with its key drugs like Avastin, Tamiflu and vitamin pills alongside other pharmaceutical companies. In a landmark lawsuit, Roche paid a record USD500m criminal fine for leading a worldwide conspiracy to raise and fix prices and allocate market shares for certain vitamins sold in the United States and other parts of the world. The conspiracy lasted from January 1990 into February 1999 and affected the vitamins most commonly used as nutritional supplements or to enrich human food and animal feed.

The full press release below:

https://www.justice.gov/archive/atr/public/press_releases/1999/2450.htm

As such, regulators are constantly watching Big Pharmas. Regulations can always screw pharma companies. Besides fines, it could be cease and desist orders on their production facilities, or it could be price caps on drugs that are too profitable. After all, if the umpire is not doing his job, then game hell breaks loose. For Pharmaworld, Purdue Pharma and Oxycontin comes to mind. That said, Roche has definitely managed these risks better than some peers and there has not been multi-billion fines or lawsuits against the company as far as I can tell.

Breakup

One idiosyncratic risk with Roche is the dissolution of its current structure housing diagnostics and drugs under one entity. Roche is the only pharma company having such a unique structure and it is not inconceivable that some activists ask for a breakup or some other kind of financial engineering to “create value”. While monetary gains could be made ultimately, it is straining on management resources and with Swiss pride and ego involved and one can imagine how volatile Roche share price can gyrate. We could see more 30% drawdowns, which is not what investors want. The mitigating factor is that at current share price, Roche is already cheap and I don’t think the downside would be big even if there is some negative newsflow on this issue.

4. Valuation

As with the previous analysis, I have used excel to triangulate valuation using Free Cashflow, Enterprise Value and Price Earnings. The Earnings column refers to free cashflow, EBITDA and Net Income respectively and we slap the multiple on for each metric. In analysis done earlier this year in the original substack post was pretty off.

Huat Ah!

No comments:

Post a Comment