This post first appeared on Substack a few months ago.

The human brain is weak. We are wired to succumb to temptations easily and we slide down slippery slopes and are unable to get back on our feet without tremendous effort. That is why it is so hard to lose weight, or stop swiping those TikTok videos or quit drinking or smoking. The common denominator for the above question is addiction. We just cannot stop ourselves when our brains from crazy over those dopamine hits. No pun intended but we are, in essence, not too different from zombies always going crazy for brains. They also cannot help it.

Businesses that leverage on this weakness become cash generating machines as consumers cannot stop consuming their products. Think sugary drinks, addictive games, new seasons of Game of Thrones and salty snacks. It gets so bad that governments have to clamp things down. Cocaine is illegal in most countries as with most drugs.

Many countries has imposed sugar tax and China restricted kids from playing games after 10pm. But that does nothing to stop these companies from churning cash because people simply cannot stop themselves from wanting more. They will still consume even if you raise prices, reduce the volume per pack or even reduce the quality of the product.

Our idea today is one such consumer company with market cap of over USD250bn, which is roughly the size of New Zealand’s GDP and almost twice the size of Ukraine’s GDP and amazingly, a tad smaller than our Little Red Dot’s GDP. We shall discuss its investment thesis, moats, risks and valuation.

The investment idea today is a compounder and a household name which I have followed for a decade as an analyst but its brands are brands I have known all my life, as I am sure most of us do. We will be discussing Pepsico (Ticker: PEP), listed on the NYSE. The stock has compounded tremendous growth for the past 40 years.

1. Investment Thesis

Pepsico is the world’s largest potato chips manufacturer and the world’s second largest bottled soda drink maker behind Coca Cola. The company has a diversified portfolio of iconic brands such as Pepsi, Frito-Lay, Gatorade, Quaker Oats, and Tropicana, among others that creates great products which are well-liked because they are savory and addictive. It has also built a strong global procurement and distribution network in 200 countries on the back of its sheer size as one of the leaders in these two consumer sectors which provides Pepsico huge competitive advantages against smaller competitors.

Today, Pepsico ranks amongst the top 5 global FMCG (fast moving consumer goods) companies and has compounded growth at minimally high single digit pace for decades. In the recent 5 years, share price has also more than doubled from c.USD80 in 2018 to c.USD180 today. The following is Pepsico's simple financials and ratios:

Simple Financials

- Sales: 89.9bn

- EBITDA: 16.3bn

- Net income: 9.7bn

- FCF: 8.3bn (current FCF in 2022 is 5.6bn)

- Debt: 36.1bn, Mkt Cap 253.9bn

Ratios

- ROE 53.7%, ROIC 16.2%

- EV/EBITDA 16.5x (Dec 24)

- PER 23.4x (Dec 24)

- PBR 14.5x

- Past margins: OPM 14-18%

Management

While Warren Buffett did famously say (below) it is not about management but more about the business, it is worth mentioning Pepsico’s previous and current CEOs. Pepsico’s success over the last two decades can be largely attributed to Indra Nooyi, who served 12 years from 2006 to 2018. Her Spanish successor, Ramon Lagurta took over well and has continued to drive growth. What Indra and her team did was both strategic and effective.

“ When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact. ”

In the years prior to becoming CEO, Indra was CFO and SVP for corporate strategy and she famously spun out Yum! Brands which was Pizza Hut, KFC and Taco Bell. These restaurant businesses did not fit well with Pepsico’s core products even though conceptually they were supposed to fit back in those days. Since you sell carbonated drinks, why not own businesses that sell those drinks day in day out? Today we know that it doesn’t work. Indra sold those businesses and bought Tropicana and Gatorade which further strengthened Pepsico’s distribution network and its business moat.

Next, Pepsico reclassified its products into three categories: "fun for you" (potato chips and regular soda), "better for you" (diet or low-fat versions of snacks and sodas), and "good for you" (oatmeal). It was easy to understand and put Pepsico in a good light as the world moved to emphasize on ESG. Her legacy continues today as her successor continue to grow profits and dividends.

2. Business Moats

Buffett also said the most important thing about businesses is how they defend their market share. He coined “Business Moats” as the term to illustrate characteristics of strong companies that would help fend off competition. For the fun of it, I asked chatGPT, “What is Pepsico’s business moat?” and the following is what it churned out:

Pepsico's business moat is primarily built on its strong brand recognition and extensive distribution network. As a leading global food and beverage company, PepsiCo has a portfolio of well-known brands such as Pepsi, Lay's, Gatorade, Quaker, Tropicana, and Doritos, among others, that have become household names.

Additionally, PepsiCo has a diversified product portfolio spanning snacks, beverages, and other food products, which helps it to maintain a stable revenue stream in different market conditions. The company also invests heavily in research and development to create innovative and sustainable products to meet changing consumer preferences.

Moreover, PepsiCo's extensive distribution network, which includes partnerships with bottlers and retailers, allows the company to reach customers across various geographies and demographics. This distribution network provides the company with a competitive advantage over smaller players who may not have the same level of reach.

Pepsico is committed to operating in a socially and environmentally responsible manner and has demonstrated ESG leadership. The company has set ambitious targets to reduce its environmental footprint, improve the lives of farmers and communities in its supply chain, and promote diversity and inclusion in its workforce. These initiatives not only benefit society but also position PepsiCo as a responsible corporate citizen and a leader in the ESG space.

Overall, PepsiCo is a well-established company with a strong brand portfolio, diversified revenue streams, and a commitment to ESG leadership. These factors, combined with its consistent financial performance, make PepsiCo a compelling investment opportunity for long-term investors looking for exposure to the food and beverage industry.

I must say this is really not bad! It picked up Indra Nooyi’s ESG leadership point as well! But alas for serious value investors’ deep dive, chatGPT is still not good enough. Maybe we can give it a few weeks and open access to Substack, after some more learning it’s game over for writers like us :)

Okay, before that happens, let’s get back Pepsi’s moats. ChatGPT got the two most important moats: brand and distribution. Brand is easy to understand, humans like familiarity and if businesses can deliver consistency, consumers will just keep coming back. Starbucks, Johnson and Johnson, L’Oreal, LVMH, Macdonald’s, Toyota, Singapore Airlines and Yakun Kaya Toast all built their businesses on consistency and reliability.

Distribution is key and towards the consumer, it is about securing shelf space in retailers, being able to restock products as soon as they run out, putting the right products in front of consumers in the right season. Drinks in summer, chips before big games. It is also vital in procurement. Get suppliers globally, procure at low costs but ensure consistent supply. Frito Lay became the largest potato chips maker because it can secure potatoes from growers all over the world. As it grows in size, it becomes harder and harder for others to secure potatoes and even if they do, competitors cannot buy at the same low price.

This is economies of scale at work. Frito Lay can procure potatoes cheaply because it has volume. This is the same for all other raw materials: packaging, PET bottles, syrup, oats etc. It can also secure shelf spaces cheaply, it then has more marketing dollars to spend, ensuring mind share with consumers.

Economies of scale → lowest cost producer → higher gross margins → more marketing spend → bigger market share

There is also a strong positive cashflow angle. Pepsico can always have better payment terms. It pays farmers some small upfront cost to grow potatoes. It pays distributors deposits to put its chips and drinks on shelves. These are cents per packet or per bottle. But when the consumer buys a packet of Ruffles at $5, the money goes to Pepsico fairly quickly because its systems are linked with retailers like Walmart and Costco. If we buy on e-commerce, then it gets money instantaneously. So Pepsico’s working capital cycle is very short. In fact, in 2022, it was negative. It was -USD6bn against revenue of USD90bn. Pepsico’s upstream supplier and downstream counterparties funds its day-to-day business operations.

As the company keeps improving its margins and cashflows, Pepsico realized it doesn’t really need a lot of equity on its balance sheet. So it kept buying back its own shares. ROE hit more than 50% since 2016. I believe there is room to further improve ROIC (c.16%) as well. It used to be just 27%! This is the beauty of FMCG businesses or in general, businesses with good economics.

3. Risks

Every investment comes with risk and we need to understand them well and see if there are any mitigating factors. Most of the time, risks can be mitigated if we buy cheap enough. For a name like Pepsico, the ability to compound also helps. It is akin to the current environment when risk free rate is 4%. If you lost 10% on some investment, cut loss and put in T-bills, you get it back and a bit more in 3 years. But with Pepsico, you just have to wait for compounding to do its work.

Anyways, let’s go through some of its key risks:

Market correction / valuation compression

As valuations are not cheap (25x PER and 18x EV/EBITDA), Pepsico and similar companies are vulnerable to any kind of market correction. Hedge funds, institutional investors will sell large, liquid and expensive names which in the past has caused 25-30% drawdown for Pepsico. This, in my opinion, is the biggest risk because it will take 4-5 years of compounding to clawback negative 25-30%. But if it falls that much, also means it will be a good opportunity to accumulate if the other risks listed below are non-issues.

Competition

This is another good point picked up by ChatGPT although its explanation was not good enough. Pepsico is constantly bombarded by competition. Arch-rival Coca Cola will not stop hammering at Pepsi’s drink business and in this new economy, there are endless shelves on Amazon and so part of its moat of having good distribution to supermarkets and good bargaining power for shelf space has become mooted. There are also new niche brands coming out every other day. Singapore’s own Dangerously Addictive Irwin’s Fish Skin and Potato Chips made such a big splash in the local scene in a few short years. You can imagine globally how many niche brands are chipping away Pepsico’s shares in both snacks and drinks.

Of course the mitigating factors are also spelt out above. Pepsico will enjoy lower costs, cheaper marketing dollars and a lot more resources to crush anyone because of its scale. Pepsico can just buy Irwin for USD250m tomorrow, which doesn’t move the needle at its USD250bn market cap and *poof* this competition is gone.

Regulations

Large companies are always vulnerable to regulatory risks and Pepsico, with its addictive sugary drink and salty snack portfolio is always in the cross-hairs of regulators’ firing squad. In the ten years from 2012 to 2022, a slew of countries passed sugar or soda tax laws to reduce consumption of sugary drinks because it became medically proven and established that sugar causes diabetes. Similar to tobacco taxes, this was argued to be good for humanity. Pepsico’s share price reacted negatively whenever announcement of countries passing the such tax bills hit the newswire. But compounding has since done its magic and it is not longer talked about today.

However, regulatory concerns will continue and in today’s context, extensive use of plastic and PET bottles could be targeted. Or anti-competitive moves could be picked up by the authorities. Lawsuits can also hit share prices. Johnson & Johnson was recently hit by Talc baby powder lawsuits (which we all used!) but a quick search will show it had been hit so many times in so many different products over decades.

While most companies survive such sagas, once in a while, we see companies falter and unable to recover. Recent examples not in the FMCG industries such as Bayer and BP come to mind. We just have to be mindful that this is part and parcel of investing in large prominent companies.

Poor execution

Highly cash generative companies can be more prone to execution risks because they are constantly being asked to distribute the cash back to shareholders if they have nothing better else to do with it. As such, management find it irresistible to buy things. Doing M&A is fun, you meet other companies senior executives, wine and dine with investment bankers’ money, get to travel and just in general being viewed internally as doing something transformative. But we also know that c.60% of all M&A fails and companies get saddled with debt.

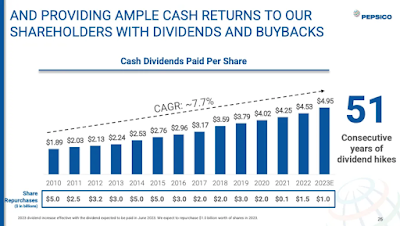

Gladly, Pepsico does not have this problem for now. It has done very good M&As and it has also returned a ton of money to shareholders. We have a chart further below showing that the company executed 51 years of consecutive dividend hikes. Gosh, that’s more years than yours truly has spent on Earth.

4. Valuation

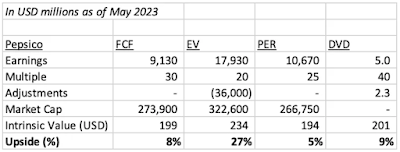

Today we will use four valuation methodologies (FCF, EV, PER and Dividend) to triangulate (or quadriangulate) the range of intrinsic value for Pepsico. I have complied the table below for easier digestion. The earnings line is essentially FCF, EBITDA, Net Income and Dividend multiplied by 8% growth (one year forward) for the four methodologies respectively.

Multiples are always the hardest and I have not done a lot work to justify the numbers above. I just looked at the recent numbers used them. As we can tell, the upside is limited and this would not past Buffett’s margin of safety test. Adjustments are done for EV to add back debt and for Dividend to add this year’s announced dividends. Intrinsic value is in per share terms and upside is calculated using the share price today is $185.

With the power of Excel, I also did a quick sensitivity test above and I brought down all the multiples above by 5 points and we have the new intrinsic values showing between 9-18% downside.

.

Recall that Pepsico has suffered maximally 30% drawdown in the past, which we should not expect in most normal circumstances. So at 9-18% downside, I would say these no.s represents good downside cases. As such the risk reward is essentially minus 9-18% vs compounding at 8-10% annually which is had done i.e. 80-100% upside over my investment horizon of 5-7 years. This is good risk reward in my opinion, but I would want that margin of safety. Let’s see how we get there

Intrinsic Value

Just using simple math, I would take the average of the four IVs above which brings Pepsico’s IV to c.$210 and this represents c.14% upside from today’s price. In order to get 30% margin of safety, I would think that the right entry price today should be c.$150-160. For full disclosure, my average price is closer to c.$80 many years ago. But at $160, I will be buying more.

.

To sum it all up, Pepsico is one of the world’s best compounder with strong core businesses in addictive products such as sugary drinks and savory snacks. The following chart says it best. According to Google, Pepsico’s share price was $2.08 this month in 1983, some 40 years ago. So if we bought then, the dividend we get this year is more than double our capital and our capital gain is 170x

Huat Ah!

This post does not constitute investment advice and should not be deemed to be an offer to buy or sell or a solicitation of an offer to buy or sell any securities or other financial instruments.