This post first appeared on 8percentpa.substack.com, as part of a new effort to share investment ideas. It is updated in Jun 2023.

Alphabet / Google (ticker: GOOG) needs no introduction. The company is the largest search engine in the world and the giant in the world of online advertising. It controls 40% of the online advertising market while Meta / Facebook has another 20%. Today, GOOG generates the bulk of its revenue from ads via search and its own services (such as Gmail) and Google Networks - websites that hosts its ads. GOOG also provides a slew of critical services that we all know well: Youtube, Google Maps, Android, Chrome and DeepMind amongst many others. In 2015, CEO Larry Page announced that a parent company Alphabet will be created to house Google and its sprawling empire of subsidiaries.

Thanks to shrewd business strategies and acquisitions, GOOG has managed to grow phenomenally almost without interruption from the beginning. The world might not have seen such a growth juggernaut. It has one quarter (or maybe two) of revenue decline since IPO! The company grew well above 20%YoY for more than a decade and continues to grow into new verticals which it can. These include cybersecurity, cloud services and A.I. enabled voice search could become very big with proliferation of smart speakers in our homes.

Despite recent noise about chatGPT and upcoming competitors, we believe the company will manage this transition better than it did during the PC-to-smartphone switch years ago. One test of a strong business moat is how our lives would be impact if hypothetically, the company cease to exist. For example, what if there had been no Pfizer, how would our lives have changed? Well, maybe a significant percentage of us wouldn’t be alive since there we won’t be vaccinated for COVID-19. Similarly if Alphabet / Google disappears today, a billion or more people including most of us here will not be able to function. So, the question is, what if chatGPT disappears today?

Meh, let’s see what’s new on Google News.

1. Fundamentals

We showed a stylized version of Google's revenue breakdown, courtesy of FourWeekMBA a few weeks ago. Google's own disclosure has always been super high level. The following is from its recent quarterly earnings results.

Amazingly, GOOG generates more than the GDP of Singapore with c.70% of its revenue from search and Google Networks, platforms that uses Google to manage advertising. The other three buckets are important by themselves. Youtube, something most kids and teenagers cannot live without today, Android, something most phone users cannot live without today and last Google Cloud, an upcoming formidable competitor to Amazon's AWS and Microsoft's Azure. Perhaps, someday, most business cannot live without these cloud services.

Here's following snapshot of GOOG’s important financial numbers and ratios:

- Revenue (2022): c.USD282bn

- 3 year revenue growth 23%

- Gross margin 55% & Operating margin 26%

- ROE 24% & ROIC 22%

- FCF USD67bn and FCF yield 4.3% (Jun 2023)

- Net cash on balance sheet c.USD90bn

2. Risks

Every investment has risks and Google's biggest threat today is none other than ChatGPT. As a frequent user, I must say I see how ChatGPT can disrupt Google. It is simply a better way to get answers. That said, Google has launched its own A.I. called Bard. Given Google's early foray into A.I. with its c.$500m purchase of DeepMind in 2014, it should have a good headstart in this arms race. I would believe that the verdict is not out yet. Even if Google eventually loses, we will have time to get out.

The bigger risk today is anti-trust and lawsuits. Google has dominated the search world for more than two decades and governments around the world has tried to break this dominance. According to chatGPT, the following are the biggest fines against Google over the last 10 odd years.

European Commission Fine (2018): In 2018, the European Commission imposed a record-breaking fine of €4.34 billion ($5.1 billion) on Google for violating antitrust laws. The Commission found that Google had abused its dominant position in the mobile market by imposing illegal restrictions on Android device manufacturers and mobile network operators.

European Commission Fine (2017): In 2017, the European Commission fined Google €2.42 billion ($2.7 billion) for favoring its own shopping comparison service in search results and demoting rival services. The Commission considered this practice to be an abuse of Google's dominant position in the search engine market.

European Commission Fine (2020): In 2020, the European Commission fined Google €1.49 billion ($1.7 billion) for abusive practices in the online advertising market. The Commission found that Google had imposed restrictive clauses on third-party websites, preventing them from displaying ads from Google's competitors.

Federal Trade Commission (FTC) Fine (2012): In 2012, Google agreed to pay a $22.5 million fine to settle charges by the FTC. The charges were related to Google's tracking of users of Apple's Safari browser without their consent, in violation of an earlier privacy settlement between Google and the FTC.

As we know, ChatGPT is known to have accuracy issues. So we need to verify the details. A simple search showed that EU indeed fined Google c.USD5bn in 2018 and the litigation process is still underway today. Google's legal team has 400 lawyers and Google's court cases have its own wikipedia page with a long list of past lawsuits.

https://en.wikipedia.org/wiki/Google_litigation

3. Technicals

GOOG peaked at c.$150 and was at c.$100 just a few months ago which was attractive. Share price has since rallied to $123 and I would argue that the margin of safety is no longer big enough. In market cap terms, it is USD1.6trn today and USD2trn at its peak. Share price bottomed at $84 in Nov 2022. At the height of covid in Mar 2020, it was c.$50. The stock went for a 20 for 1 split in July 2022 and these are no.s post split.

If we use $50 as the low, $123 for current price at $150 for the upside. The risk reward is now skewed towards the downside. We have to make the assumption that share price can see $200 or more before the risk reward becomes palatable. As such, based on the above, Google is not too attractive for entry today, but since I am holding on to it, I will continue to do so unless there are more attractive similar opportunities out there.

4. Valuations

The chart below compares Google with its associated peers which may or may not be direct competitors. We can see that Google trades below this peer group average for all measures (PE, EV/EBITDA, Price-to-Sales or PS and FCF yield). It is worth noting that Free Cashflow (FCF) was USD11-13bn in 2012 and if we extrapolate its growth from then till now, it should be able to generate USD100bn in FCF in a few years alongside Apple. Although Apple would probably also grow its FCF bigger, maybe to USD150bn!

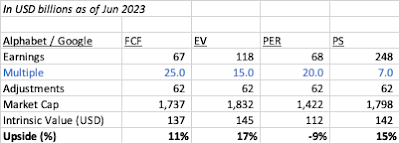

Triangulating the various valuation metrics below, we can see that Google's upside range from -9% to 17% which, as discussed above, does not warrant enough margin of safety.

If we bump up the multiples across (FCF to 30x, EV to 18x, PER to 25x and PS to 8x), we do get some upside but that's really stretching and not wise with the global recession looming and the disruption of chatGPT uncertain.

Previously at Substack, we had GOOG’s intrinsic value at $150 which was its peak in 2022. Perhaps things shouldn't be changing too much in just 6 months. Alphabet / Google is a HOLD now.

Huat Ah!