This post first appeared on 8percentpa.substack.com, as part of a new effort to share investment ideas.

Why do humans love stories?

Ever since our brains evolved to develop language, we have been telling stories to one another. Stories activate our cognitive brains and bring us into different realities which we believe can be perfect and we escape into them to forget about our not-so-perfect lives.

But stories can also inspire us to become better versions of ourselves. We worship both ancient Greek heroes and Marvel superheroes and aspire to be like them. We empathize with our heroes when they go through their challenges and rejoice with them when they finally overcome their nemeses and live happily ever after.

In recent years, storytelling has reached a whole new level with Hollywood and Netflix throwing billions of dollars into content creation. Disney up its game with the Avenger series and we see its peers following suit. On top of that, big budget television series, reality programs, anime and a slew of alternative content now proliferate our lives and our minds.

As such, our bet today is an overlooked content company created in the midst of the pandemic.

Investment Idea: Warner Bro Discovery

Warner Bros Discovery (WBD) was created with the merger of Warner Brothers Media and Discovery Inc in 2021-22. The stock price has corrected from $24 to $10 since its inception and looks amazingly cheap at teens free cashflow yield (FCF) today.

1. Fundamentals

The company now houses some of best brands and franchises outside of Disney under one roof (see slide from 2Q2022 investor presentation below). These include DC Comic, HBO, Harry Potter, CNN and Cartoon Network, amongst many other franchises. According to CEO David Zaslav, WBD probably has 35% market share of the best content on Earth, as much as Disney does. There is so much room to extract value but the market is not appreciating WBD’s value and not valuing the company as such.

As a result of the various past mergers, including the final mega combination between Discovery and Warner, one can also expect that a lot of duplicated costs can be reduced. Cost synergies is estimated to be USD3.5bn and while sales synergies are not factored in, it should also be significant. Just think about how Harry Potter and DC can now go on HBO and Cartoon Network or how they can further milk the Game of Thrones franchise as they already did with the House of Dragons.

The following is a set of simple financials projects WBD’s financial prowess in 2023. In the base case scenario, the company can create USD4bn on free cashflow (FCF) on its market cap of USD25bn:

Simple financials (estimated for Dec 2023, USD)

Sales: 48bn

EBITDA: 11bn

Net income: 500m

FCF: 4bn (current FCF in 2022 is 3bn)

Debt: 50bn, Mkt Cap: 25bn

Ratios

ROE 9% ROIC 6%

EV/EBITDA 7x

Past margins: OPM 20-30%

By comparison, Disney generated USD5-8bn of free cashflow pre-pandemic and achieved teens ROE which should be the levels that WBD can aspire to reach in the next 2-3 years. That said, the next few years does not bode well for Disney as it struggles with management succession and its streaming business. The same key risk can be said for WBD.

Risks

WBD faces the possibility of not being able to turnaround streaming losses (USD500m per quarter) and continued hiccups in execution, will mean that the abovementioned potential will continue to be unrealized. The mitigating factor is that with its lucrative content library, WBD might be taken over by another operator to achieve its potential. So by investing today, we should not lose money.

The second smaller risk is WBD’s balance sheet. With USD50bn of debt (against market cap of USD25bn) and rising interest rates, things could spiral out of hand if this debt and its interest expenses are not managed well. The mitigating factor is its strong FCF generation. At the current estimated range of USD3-6bn FCF annually, WBD could pay down its debt in c.8-16 years.

2. Technicals

WBD traded to $80 as a mime stock when it was still Discovery Inc (the deal was already announced). and it is not a stretch to imagine it can be valued as such given the strong FCF, franchise and leadership under David Zaslav, who was under the tutelage of John Malone, one of the best business leaders of our times.

David Zaslav alluded to this target in a recent podcast. He also shared that his stock options only make good money when the share price hit USD30 and beyond. We are also seeing insiders buying at current levels. These “technical” signals bodes well.

After it started trading as WBD in Apr 2022, the share price dropped from USD24 to its current USD10, a 60% drop reflecting the weakness in the markets. Its highest point was above USD30 shortly after the launch of its new ticker and it traded as low as USD8.8 recently. Thus, on many counts, the current share price presents a good risk reward profile.

3. Valuations

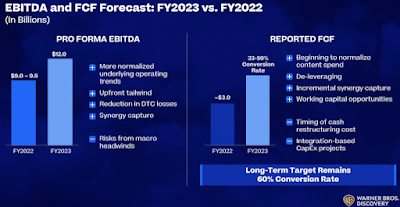

Warner Bros Discovery measures FCF and EBITDA closely and therefore we can use FCF yield and EV/EBITDA as the appropriate valuation metrics to triangulate its intrinsic value. Starting with FCF, WBD currently has a market cap of USD25bn and management expects free cashflow to hit USD3bn in 2022 and somewhere between USD4-6bn in the future, calculated from its EBITDA to FCF conversion ratio of 33-50%.

This implies its FCF yield is 12% using the USD3bn number and a whopping 24% if we believe WBD can make USD6bn in FCF. As a rule of thumb, an intact business (i.e. not declining business) with FCF 10% yield is what investors will kill for because we do not have to sell. We can technically hold it forever since this asset is going to give us 10% every year, perpetually.

WBD is trading way beyond this FCF 10% yield benchmark.

Similarly, we can use EV/EBITDA to value WBD. Management is guiding USD12bn in EBITDA next year but we have conservatively estimated that it will miss by a billion, achieving USD11bn. Using its current EV of USD75bn (market cap of 25bn + debt 50bn, WBD is trading at 6.8x EV/EBITDA, which is considerably cheaper than most of its peers (Disney at high teens and Netflix at over 20x).

4. Intrinsic Value

Assuming that WBD trades 8x EV/EBITDA on next year's USD11bn of EBITDA, WBD should have an EV of USD88bn and after deducting its USD50bn debt, its market cap should be closer to USD38bn (not the current USD25bn). If we use current EBITDA of USD9.5bn and similarly give it the 8x, then we get to a more conservative EV of USD76bn. After we deduct the USD50bn, we still get USD26bn of market cap, which is still 4% above today’s share price.

WBD is incredibly cheap!

Let's see how it looks like if we use FCF. Assuming FCF is at USD4bn and giving it 15x (or 6.7% FCF yield) which is again at a discount to its peers, WBD should trade at a market cap of USD60bn i.e. 140% above its current market cap. This translates WBD’s intrinsic value to USD24 per share.

If we look at its peers, Disney, Netflix, Comcast, they are trading at USD219bn, USD107bn and USD171bn respectively with EBITDA at USD12bn, USD19bn and USD36bn. The average market cap is USD166bn over an average EBITDA of 22bn. Without doing a full regression analysis, we can intrapolate the above numbers back to WBD's market cap using its current EBITDA of USD9.5bn, it implies that WBD should trade closer to USD72bn.

Taking the average of the four market caps, USD38bn, USD26bn, USD60bn and USD72bn, we get to an intrinsic value (IV) of USD49bn in market cap or USD20 per share. As such, we would put WBD's IV at 20 with over 90% upside from today’s price.

Huat Ah!

Read it at https://8percentpa.substack.com/p/investment-idea-2 and please support by subscribing at substack, thanks!

This post does not constitute investment advice and should not be deemed to be an offer to buy or sell or a solicitation of an offer to buy or sell any securities or other financial instruments.

No comments:

Post a Comment