We had discussed a lot about investing myths in the past and here's a post to really bust them once and for all.

1. Investing can make you filthy rich

I think this notion deserves a lot more analysis and the way I would think of it is to look at the top 10 or even the top 100 richest people in world, in each region and also in Singapore. Investors seldom get featured on these lists. The most famous rich investor remains to be Warren Buffett. In Asia, there is no equivalent. Most of the richest Asians are either entrepreneurs or property tycoons.

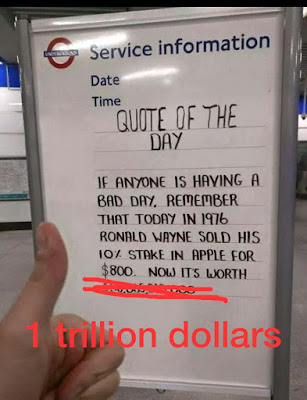

The second argument relates more to mundane mortals like us and here the stats don't lie. Over 90% of all retail investors don't make money while 80% of professional fund managers don't beat their benchmark like the S&P 500 which generates 8-10% per annum return over time. Putting these together it means that an average investor doesn't even get close to high single digit returns annually. If that is the case, on average, how can we expect investing to make us filthy rich?

Getting rich through hard work and compounding!

But having said all that, I would say the fruits of labour awaits the diligent and the intelligent investor and if we do achieve 8% return annually, over a span of 10-20 years, we can increase our wealth by a factor 3-4x. This is the goal! It's achievable with effort, grit and time. There is an early post in this blog addressing this exact topic. In short, investing can make you rich if you are really patient and really trying hard and putting in the effort required. But it’s a tall order to make you filthy rich.

2. Investors spend ten hours in front of four trading screens

Most laypeople probably have no idea what real investors do. We get our notions watching Hollywood or old Hong Kong drama depicting investors as big shots in front of trading screens. Actually, real investors rarely spend time in front of screens reading charts. We spend 80-90% of the time reading. We are constantly reading newspaper, annual reports, business magazines and what other investors write. The remaining 10-20% of the time, we either talk to other boring industry people or watch investment related videos or we write own our thoughts for other investors to read, haha. That's the truth.

3. Investors can predict markets

Well, sorry, investors cannot predict nothing and so does everyone else. The future cannot be predicted. It exists as a set of probabilities at any given time and people who are predicting don't know any better. So don't be fooled. The space-time continuum is one of the least understood physics of our universe. The current way we think how our universe works might be completely missing the point. It was postulated that every action that every single one of us takes might create a new universe and a new reality in a whole continuum of realities. That's like 7 billion universes and realities every split second. It's literally to infinity and beyond! If that's truly the case, then how can anyone ever predict markets?

So the way to think about the future when it pertains to investing and making money is to know how the big probabilities and the big scenarios would play out. There would be times when the risk-reward is skewed such that in the bear case scenarios we don't lose much but in central and bull case scenarios we make a lot of money. That's when we bet and make the outsized expected returns. This usually ties in with valuation. When we buy things cheap, we protect ourselves against the bear case scenarios. This is why value investing is always about buying cheap, margin of safety and strong business moats.

4. Investing is super exciting

Investing is boring!

Well, this is probably the biggest myth i.e. this statement is the furthest from the truth. Investing is super boring for most people. This is a job that requires you to read and read and read some more, then talk to boring people. Sometimes we get to go visit companies' HQ and sit through meetings after meetings. It's called Death by Marathon Meetings. If we get real lucky, we get resurrected during lunch and then "afternoon dessert" get served - Death by Powerpoint. Hahaha! George Soros said it best - good investing is boring. It becomes fun a bit like how some foodies get acquired taste for certain foods. Like how some Korean food lovers acquired the taste of eating live octopuses or how some people like blue cheese or stinky tofu.

5. Investors are like Hollywood hotshots

As you would have guessed by now, investors are no hotshots. Investors are mostly boring people with limited communication skills. They talk in their own jargons and have no clue who's BTS or Twice. (BTS might ring a wrong bell as Bangkok's railway system.) Most teenagers wouldn't want to hang out with the best investors in the world. Just look at the two of them below! Again, it's really acquired taste for people who idolize these two cute grandfathers!

There is a new breed of younger investors who can stand somewhat closer to George Clooney and Robert Downey Jr if they tried. They are Dan Loeb, David Einhorn and Bill Ackman as depicted below. But still, they wouldn't be considered your regular heart-throbs. Ironically, their value goes up as they age in the world of investing. So they would really become iconic and super famous and well-known to the general public say twenty years from now, when they look more like Warren and Charlie above!

Alas, there are no pretty investors. That is a sad fact in both real life and in the movies. The closest Hollywood ever managed to depict was a femme fatale serial entrepreneur in The Intern. Such a person doesn't exist, at least in our current universe and current reality :)

So that's the five myth busted. Are we ready for some real boring investing? Anne Hathaway would have this to say,

"I've honestly been really lucky, my only jobs have been babysitting and acting."

Huat Ah!