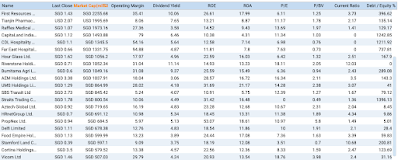

- Market cap > SGD 500m

- ROE > 10%

- ROA > 4%

- Dividend Yield > 3%

- PE < 25x

Thursday, January 18, 2024

2024 Dividend List - SGX

Friday, January 12, 2024

[Globe Newswire] Fraser Institute News Release: Hong Kong plummets to 46th spot in latest Human Freedom ranking

This is a collaboration post with Globe Newswire which provides earnings update and salient financial news globally. Please click on the links after the introductory excerpts for their full articles.

TORONTO, Dec. 19, 2023 (GLOBE NEWSWIRE) -- As a result of increasing restrictions on liberties in Hong Kong—once among the freest places on earth—it now ranks 46th in the latest Human Freedom Index report, released today by Canada’s Fraser Institute and the U.S.-based Cato Institute.

As recently as 2010, Hong Kong was the 3rd freest jurisdiction on earth. Mainland China has always been less free than the territory and this year, China ranks 149th out of 165 jurisdictions.

“Freedom has suffered a precipitous decline in Hong Kong, but its tragic descent into oppression provides important lessons about the value of freedom,” said Fred McMahon, resident fellow at the Fraser Institute and co-author of this year’s report.

The index measures personal freedom—the rule of law, safety and security, identity and relationships (i.e. the freedom to choose your relationship partner), freedom of movement, speech, assembly and religion—alongside economic freedom, the ability of individuals to make their own economic decisions.

This year’s report ranks 165 jurisdictions around the world. It finds that from 2019 to 2021 (the latest year of available data), 89.8 per cent of the world’s population experienced a decline in freedom.

Full article:

https://www.globenewswire.com/news-release/2023/12/19/2798336/0/en/Fraser-Institute-News-Release-Hong-Kong-plummets-to-46th-spot-in-latest-Human-Freedom-ranking-as-China-continues-to-violate-one-country-two-systems-pact.html

Friday, January 05, 2024

Happy New Year! Live Nation!

This post first appeared on http://8percentpa.substack.com

Happy New Year! We shall start 2024 with a deep dive into this company!

This company is not our typical strong financials, high ROE and high margin company. Its net income is barely positive and this makes the Price Earnings Ratio (PER) and Return on Equity (ROE) numbers look erratic. But FCF generation is strong and growing which makes the stock worth looking at. Again, let’s start with the financials.

Simple financials (Dec 2023, USD)

- Sales: 19.1bn

- EBITDA: 1.7bn

- Net income: 0.2bn

- FCF: 1.0bn

- Debt: 4.9bn, Mkt Cap 20.4bn

Ratios

- ROIC 8.0%

- EV/EBITDA 11.7x (Dec 24)

- PER 78.5x (Dec 24)

- Past margins: OPM 5%

- FCF yield: mid to high single digit for the last few years

Before 2009, the company was generating negative FCF as it just started building its moat and it only started generating three digit million FCF from around 2012. But when the pandemic hit in 2020, FCF turned hugely negative to -USD1.3bn but has since recovered strongly. Analysts expect FCF to be USD1-2bn in the next 3 years.

The company is Live Nation and it goes by the ticker LYV and is listed on the NYSE. Live Nation is the world’s largest concert promoter organizing 40,000 events for almost 100m fans globally. Its ticketing platform, Ticketmaster sold over 485m tickets to music, sporting and other events. It also provide artists management services to c.500 artists.

1. Fundamentals

Live Nation is the leading live entertainment ticketing sales and marketing company and has one of the world’s largest music advertising networks for corporate brands. The company is a platform connecting fans, venues, tickets, artists and advertisers and operates a growth flywheel based on the above which we shall describe later.

Live entertainment is a huge megatrend because so much of our lives are now with screens, in-screens or for screens, like taking pics of our food before every meal for Instagram. So very ironically, we treasure every sliver of live interaction and will pay an arm and a leg to see our favourite artists “live” with friends and family.

The last three paragraphs pretty much summarized the investment thesis. Next, I would point you to the following link to better understand LYV’s flywheel since the blogger has done a much better job than I could ever do:

https://punchcardblog.wordpress.com/2015/03/05/live-nation-entertainment-an-unregulated-monopoly/

I would simply add what has since transpired has further strengthened the LYV flywheel starting with

Fans → Tickets → Venue → Artists → Advertisers → Platform

churning out Cash and Compounding even more Growth as we speak. Let’s go through them.

Fans and tickets: With no live concerts for the last couple of years no thanks to the pandemic, LYV has accumulated a lot more fans in 2022 due to the pent up demand. It was 60m in 2015 and it is 100m now. Similarly, LYV has sold much more tickets, from 150m in 2015 to over 450m today! People just cannot get enough of live concerts.

Venues: LYV has been building this moat for years. All counted (below), it has over 300 venues in operations, both owned and leased. It has full ownership of 30 venues including 10 amphitheaters which are most conducive for music concerts. It also has 100 international venues. This makes LYV one of the largest venue operators in globally alongside ASM Global (unlisted), its main rival and partner.

Artist and Advertisers: Similarly, LYV has continued to grow its clout with artists and advertisers further enhancing its platform to grow revenue from its successful flywheel model. Its key artists include: Aerosmith, Beyonce, P!nk and Twice, the Korean girl band, amongst many others:

https://www.livenation.com/artist-sitemap

Management

Oftentimes the people make the business and for LYV, this is an important element to discuss. In this sense, LYV is not our consumer staples or razor blade model where the business economics triumph management. Fortunately, LYV is helmed by strong managers, starting with John C. Malone, who built a media empire with various companies, most notably Liberty Global and is the largest private landowner in the US.

Live Nation, being part of the the Liberty media group of companies, enjoys advantages such as not being penalized for having too much debt and prioritizing free cashflow over net income. Liberty companies are known for the above and LYV’s CEO Michael Rapino, John Malone’s trusted lieutenant and LYV’s CFO Joe Berchtold have mastered the art of managing for cashflows.

Both have served more than 10 years. Michael was appointed as CEO since Aug 2005 and has led the company through two crises: GFC and COVID-19. Looking through the 10K pages on managers, there is a mix of young and experienced managers, not necessarily in the right pecking order, which perhaps says something about Michael Rapino. But tough managers run great businesses, fortunately or unfortunately. That’s life.

Risks

Interestingly LYV lists personalities and relationships as its #1 risk. The ability to secure popular artists for concerts and the ability to sign new artists onto LYV’s platform relies the soft skills of agents, promoters and special relationship managers that represent artists. So while LYV has built the network, flywheel and all, it can be a brother, uncle or friend of the artists who decides that the star should work with somebody else and not Live Nation. As such, LYV believes relationships are its key risk, which may be true.

The mitigating factor is that as LYV grows, it will have more clout, it can provide better economics and it has the best venues which means that musicians have limited choice but to work with LYV. Sometimes, Live Nation could provide the best option and pay the highest dollar and money talks. So, the stubborn brother, uncle or friend will get overruled by economics. As such, over time, this risk should diminish.

The second biggest risk in my opinion could be the firm’s balance sheet. LYV has c.USD6bn of net debt and cost of servicing this debt is 4.7% which works out to be USD128m. This is c.15% of its operating income and FCF which is not small. Should earnings dropped significantly like what happened during the pandemic, LYV could run out of equity and need financing.

As a matter of fact, it has very little equity. As of Dec 22, its total equity was USD93m. The mitigating factor is that as a Liberty / John Malone company, banks, analysts, suppliers know that someone will back things up if LYV really gets into trouble. That said, it is not ideal and the hope is that its strong FCF generation at c.USD1bn (which can be used to pay down debt) will make this problem go away in a few years.

Other risks would include Pandemic Part II, injuries at events, cybersecurity and legal risk related to Ticketmaster which we have little visibility. It happens when it happens and we assess then whether it’s actually a good chance to add more. The Ticketmaster legal risk is worth monitoring as the DOJ recently fined the firm USD10m, which is inconsequential but not insignificant as it sets the precedent. As the incumbent monopoly, it will always be targeted and we need to be vigilant in monitoring the legal / regulatory risk. Next, we talk about technicals.

2. Technicals

LYV became a public company in 2006 and the following chart shows the share price movement over this past 17 years. In the early years, as it was still small, share price was quite volatile and drawdown could be treacherously big. From the peak in 2007 to the trough in 2009, it collapsed 80%. More recently, it crashed 45-50% in 2020 and 2022, partly due to the high debt problem we highlighted.

So this is not a stock for the weak stomach. We cannot rule out a huge drawdown but we can try to establish a bottom and better triangulate that using valuation in the next section. At the height of the pandemic, it hit $40 and the recent low in 2023 was $66.23 as shown on the chart above. Let’s see which number works better using robust valuation methodologies.

3. Valuations

LYV’s valuation has always been tricky. It is not an easy company to value given the complexity around little net income, highly leverage balance sheet and inexplicably, negative equity before minority interest. I have used the same methodologies from past analyses below to triangulate its intrinsic value and the results are mixed.

As expected, for PER, there is no upside even if we used a generous net income assumption of USD800m, a level I hope it can achieve at a sustainable state in the future. This year’s net income, as mentioned, was below USD200m and analysts are looking at USD400m in Dec 2024. so USD800m is a lot higher.

We do have some upside using FCF of USD1bn and EBITDA of USD1.8bn and ascribing the respective multiples. But there is no margin of safety with intrinsic value at just 20-23% above today’s share price. We need 30-40%. Co-incindentally, LYV’s share price hit all time high at $120 (just 31% above today’s share price), during the meme stock mania in the middle of the pandemic, which is not far from our first cut intrinsic values of $110-112.

Next let's look at the bear case:

If we cut earnings by half while maintaining the same multiples (FCF at 25x, EV at 15x and PER at 25x), we see downside of 40-52% which was similar to the drawdowns in the past two years.

Putting the two scenarios together, we have the risk at -50% but the reward at only 20%. The risk reward is therefore skewed towards the downside and it may not be a great idea to buy at current price.

4. Intrinsic value

The most important ratio in any stock analysis is the ROIC or ROE but it is difficult to establish that number for LYV since its net income has been negative for the majority of the years it was listed. Last year’s ROIC miraculously hit 8% but it could be just one off.

I have used FCF divided by invested capital (net debt plus equity) instead to try to determine a sustainable ROIC and narrowed that to a range of 8-10% which seemed reasonable. A simple illustration is that LYV’s average FCF for the last decade was USD400m while its average invested capital (average net debt plus equity) was USD4.6bn. Dividing the former by the latter gives us c.9% ROIC.

Simplistically, this means that LYV can compound its capital at 9% per annum and if we are willing to look out two years, LYV’s intrinsic value is then $112 x (1.09)^2 = $133. At today’s price of $91, the risk reward is still not great but if we get in at $70, the risk reward becomes $40/$70 vs $70/$133 which is -43% vs 90%. And that’s ideal.

So do monitor this name closely at $70! My portfolio will be adding at $70. In fact, the team held it since 2016 when it was $20. The hope is that this could be a ten bagger some day.

Huat Ah!