I talked to a friend some time back and he asked an interesting question - can Value Investing be automated? What is the Value Investing algorithm? I thought long and hard about this. It should be possible. In fact, everything can be automated. It is just a matter of inputs, processes and output. Some processes have a lot of complexity but in theory, it is always possible. As complex as life can be, our DNA is an algorithm, determining how we eat, love, sleep, reproduce, fall sick and die. So, the answer is yes, value investing can be automated. The question is how. How can we put Warren and Charlie's wisdom into a box?

World's greatest living investors: Warren Buffett, 91 and Charlie Munger, 97

Before we answer that though, let's think about why it hasn't been done yet. Well, maybe it is too hard. There are too many inputs. Market share, number of competitors, profit per employee (including part-timers), culture, CEO's ambition, regulator's scrutiny, branding, strength of eco-system etc. For most of these inputs, you cannot put them into numbers, like how do you transform Coca Cola's brand value into a quantifiable number? Or how can we quantify Costco's business model of using peoples' homes as inventory storage thereby reducing its own cost of business? So if there are ways to quantify these attributes and put them into an algorithm, then perhaps the true essence of Value Investing can someday be digital. We can then figuratively put the world's greatest living investors into an ultimate money-making box that anyone can use to make tonnes of money.

Until we can do that, human value investors will still have the advantage.

The other problem with the markets and not just value investing is that everything affects everything else. The algorithm is not run independently and is affected by "other inputs" which we have no control over. This could be interest rates, wars, pandemics, politicians, terrorist attacks, new discoveries, blockbuster games or movies that no one expected etc. How will our algorithm be affected by these and how can we model them in? It is not easy. To add to that complexity, stock prices and stock markets are also affected by what other people do. It is a psychological game.

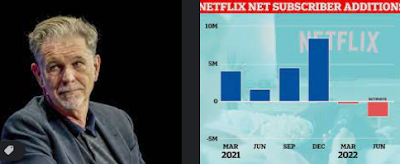

The case studies that come to mind are Netflix and Peleton. Peleton is Netflix combining a gym class while cycling at home. It became the ultimate pandemic start-up play. But its share price is affected by how people buy it up and down depending on the mood of the day. I couldn't say it has a solid business model but the market believed it did one day, then not so the next day. So the stock did just that. However, Netflix does have a solid business, it has hundreds of millions of subscribers paying $10-20 a month. Most readers on this blog cannot cancel Netflix even if we want to because our kids will scream at us. I am sure some hard-core value investors out there have figured out the intrinsic value of Netflix and will be looking to buy at a certain price. But can we create an algorithm so strong that we can also churn out the right intrinsic value, for Netflix, Peleton and all the 10,000 listed companies in the world?

Courtesy of Google images: Netflix's CEO Reed Hastings and Netflix's recent sub numbers

Ultimately, it comes back to valuations. If we buy something expensive, then it is inevitable that when the market mood swings towards negativity, the stock trades below our buying price, which hopefully is below its intrinsic value. Then there is still hope it will go back up someday. Recall that intrinsic value is always a range, it is not an exact number. As such, investing is not a science, which implies that creating an algorithm is inherently difficult.

In its most basic form, the intrinsic value depends on the company's earnings or income and a multiplier. The multiplier is based on the industry dynamics, the companies' earnings power which is exemplified as margins and ROEs, interest rates and investors' sentiment, amongst other things. The right multiplier gets redefined depending on the times. When I started this blog around 15 years ago, something trading above 25x price earnings is considered so expensive that I would not touch with a ten foot pole. Then I found that there is nothing to buy. I started buying stocks above 25x price earnings. Now, it looks like my original rule based on prudence may come back in vogue again.

However it is possible to use screens and quant trading based on valuations to make money. There are many quant shops that have done it. They made good money. Renaissance Technologies have gone a few steps further to perfect the quant-based money making machine. It delivered annualized c.40% returns over 40 years! Even putting Warren Buffett in a box could not have generated those kinds of returns.

What's most important for me though is that Value Investing is a journey. As we read about interesting companies and learn about their businesses, we understand the world that we live in. I become a better person as I become a better investor. If I created an algorithm just to find value stocks and buy blindly, then where is the fun in all this?

That said, investing is not for everyone. If you do not have the time, passion and gut to stomach painful losses, it is best just to buy the index. That is the next best thing to putting Buffett in a box.

Huat Ah!