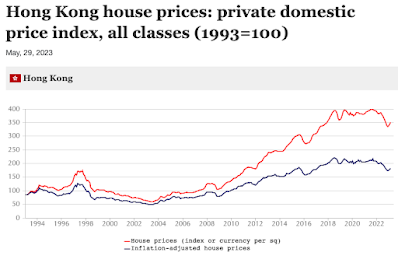

Found a good chart on the usual Visual Capitalist site, one of the most powerful visualization of data and statistics platform around.

Will we see a day it costs USD100bn to host the Olympics? That would just be a matter of time. Inflation should most certainly take care of that. We will also see the first 10 trillion dollar company, the first trillionaire, the economies would be measured in quadrillions!