This post first appeared on my substack page - 8percentpa.substack.com and I have repackaged and reproduced it here as this idea remains very palatable and perhaps relevant for everyone since T-bills are risk free. Your grandmother should buy T-bills.

We have also discussed T bills below:

Singapore T-bills Full Analysis

Invest in Risk Free Singapore T-Bills!

Only Singaporeans and Singapore's Permanent Residents can invest in T bills. But I did some googling and surfed around at:

https://www.treasurydirect.gov/

I believe the process is similar and most investors can similarly invest and earn c.4% annual return by buying US government T-bills. This post serves to illustrate the strategy and process to go about doing this investment optimally and how to think about your savings in a broader context. Ok, let's dive into it.

1. Fundamentals

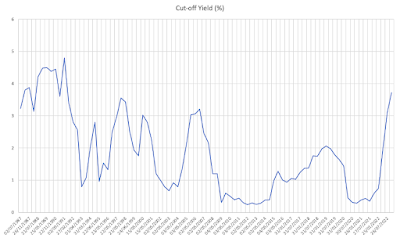

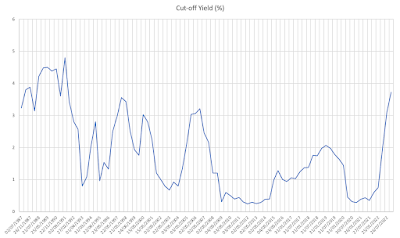

The chart below shows the cut-off yield for Singapore Government T-bills with data going back to 1987, when Singapore was a developing country. In the past 20 years, Singapore established herself as one of the global financial hub and as such, we should pay more attention to data around the new millennium.

We can see that the last era of high yield T-bills was around 2005-07 when yields hovered around c.3%. China was on the rise and together with her ascent, commodities boomed. At the same time, the housing bubble in the US which subsequently led to GFC started to take shape.

Thereafter, as we know all too well, the GFC broke out and brought our financial system to the brink of collapse. Global quantitative easing (QE) came to the rescue and interest rates stayed low since then. We have not seen SG T-bills anywhere near investable levels although 2018-19 saw it rising to c.2%. This was because the US Fed tried some quantitative tapering but stopped abruptly when the pandemic struck.

In 2022, the global low yielding investment environment ended when the US Fed raised interest rates to 4% and vowed to bring it higher to tame inflation. We are still seeing higher interest rates as of this writing. We are now in a new regime.

In the previous regime which started after the GFC, global interest rates were reduced to zero and liquidity flooded the global financial system to prevent it from collapsing. This led to cheap money chasing high returns, which exacerbated booms in private equity, startups and new speculative asset classes like crypto-currencies in the last few years.

Those days are over.

This is a new high interest rate regime, where the all important risk-free rate has now reverted back to the levels of 3-4% depicted in financial textbooks, where it should be. Since money is no longer cheap, it doesn’t make sense to chase high yielding dangerous instruments and growth companies with crazy valuations any more.

This new regime will reset how markets think about yields and valuations. 5% is no longer high yield. We are seeing startups imploding, crypto has also collapsed and we have seen most high PER companies coming back down from the stratosphere.

Pertaining to the topic today, the optionality of having cash sitting around back then was good and the negative impact was negligible. We can hold a lot of cash and do nothing without losing much. But now we are able to earn 4% on this cash. As such, cash savings with nowhere to invest needs to be put into T-bills to earn returns as much and as fast as possible. We need a good strategy and process to handle that.

2. Strategy and Process

The strategy is really simple. There is an auction every two weeks for the 6 Month T-bills in Singapore. Since the minimum size to invest is $1,000, we can technically split our full investment size into 12 tranches and bid for the T-bills every two weeks. After 6 months the money comes back and you can do everything all over again. The auction calendar is posted on the MAS website and it pays to note down all the dates so that we won’t miss them.

There are different ways to split the tranches. You may choose to do 6 ie only do alternate auction. But you also stand the risk of not participating if the one you skipped happens to be a good tranche with a very high yield. Therefore, to me, the simplest way is to participate every round, especially since the yields are going up and should remain high in 2023.

Competitive vs non-competitive bids

When subscribing, we will be asked whether we want to do a competitive or a non-competitive bid. In a competitive bid, you put the yield you want (say 4%) and you will get full allocation but risk getting nothing if your bid is higher than the cut-off yield. While in a non-competitive bid, you will take what others have bidded as the final offer ie the cut-off yield. The caveat is that when the auction is hot, sometimes you do not get full allocation with a non-competitive bid.

It is a small point and both ways work. So far, I have always chosen non-competitive. If I do not get full allocation, the money is recycled for the next tranche. This works well for my strategy for having 12 tranches. One last point to note is that the yield is annualized, but the T-bills is only for 6 months. So effectively, if the yield is 4%, you are only getting 2% of the money coming in. As such, it is important to keep the cycle going to earn the 4%.

In the last few paragraphs below, we shall describe the risk and how this saving enhancement can work for us in the broader context.

3. Risks

We briefly talked about the risk free rate described in textbooks. By definition, T-bills are risk free. The Singapore government will not collapse in the foreseeable future. You will not lose money. So it makes sense to put as much as you can into it. Only when you find a better investment, generating twice or thrice the return you can get here, then deploy part of the money into such attractive alternatives.

As you can see, how the world has changed since the days of zero interest rate. Unless some other investment can give 8% return or more, it doesn’t make sense to invest. All the REITs giving 5% dividend today are no longer attractive. Why should I risk losing money to get 5% when I can get T-bills for 4% with zero risk?

But is it really risk free?

I would say that the risk lies with future optionality. You lose optionality for six months when you put money into T-bills. For example, if there is a freak auction, the cut-off yield dropped to 2% for some reason, then we are stuck at this low return for six months. Hence again, it is good to split out to small amounts such that the “damage” is not big every round. Even if we are stuck, it is a manageable quantity and only for 6 months.

More importantly, as the chart with cut-off yield from 1987 to 2023 showed (reproduced above), when we transition to a high yielding environment, it usually lasts for c.3 years. We are at the start of this cycle and this should be a good saving enhancement instrument for the next few years.

4. Savings Enhancement

This is an important point illustrated by Mr. Money Moustache years ago. The big idea was that if you have a retirement stash and your expenses are 4% of your stash / retirement portfolio, essentially you will never run out of money. This has been established in the landmark study called the Trinity Study. The full post below:

https://www.mrmoneymustache.com/2012/05/29/how-much-do-i-need-for-retirement/

Amalgamating with our point today, if T-bills can earn us 4%, what if we deploy all our savings into this instrument? Forget about stock ideas, bonds, innovative trades, mutual funds. Just buy this lah! Isn’t that good enough? Our stash can then last forever as long as the return stays high at 3-4%. I believe that this could be the ultimate saving enhancement strategy.

To be more conservative, say we are spending 6% of the retirement stash, this means that by investing all the savings in T-bills, we will be only expensing away 2-3% of the retirement stash. So, originally, if we spent 6% of our savings, our stash could only last 16-17 years, this is now enhanced to 33 or 50 years!

For the older readers here, you will understand, this is way more than enough. We are definitely not around in 50 years. The goal is not to leave a huge stash of money when we pass, so this will help with our saving enhancement. For younger readers, work hard, save a lot more than you earn today and someday the math will work out also ;)

Huat Ah!