5 July 2022 Update: Apologies for the mis-information and the anxiety that this post might have caused. While SPH is not longer around, SPH Reit is not delisted and was last traded today at $0.90. Cuscaden's chain offer would only privatize the company if it managed to buy more than 90% of outstanding shares. Since the lowball offer ($0.9372) was unattractive, it only acquired c.62%.

I have kept this post for readers who may still be interested. Will be updating on this name in the weeks ahead now that we have an actual bid at $0.9372 (which means at 15-20% discount from this price, this name will have really good margin of safety and worth taking a very close look) and there should be further developments.

Today is the last day you can trade SPH Reit. This was a stock I owned since its IPO and it is sad that I have to sell it the way I did. It was definitely not trading at my intrinsic value but I have not choice, unfortunately. In Singapore, minority shareholders continue to suffer when stocks are taken private cheaply.

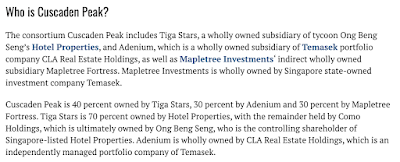

For the uninitiated, the saga began around March with SPH Reit's parentco SPH embroiled in a bidding war sparked between Keppel Corp and Cuscaden Peak. Cuscaden Peak is a vehicle owned by Singapore #1 shrewd businessman Ong Beng Seng who has strong connection with Temasek. The actual shareholding is a bit complicated and I have copied the description from Shentonwire (pic below): https://shentonwire.net/2022/06/02/cuscaden-peaks-chain-offer-for-sph-reit-turns-unconditional/

To cut the story short, Cuscaden won and SPH, Singapore Press Holdings, publisher of The Straits Times, was taken private last month, ending its life as a public blue chip company on the SGX. Some shareholders took umbrage that it was taken out at SGD2.40 while most long term investors would remember this stock should be valued closer to SGD4.00, which was where it traded for donkey years.

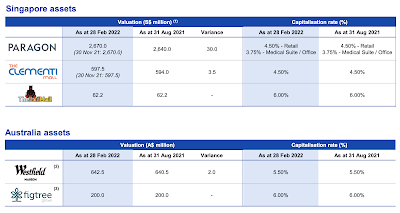

SPH Reit was then bidded to be taken private at $0.9372 as part of a chain offer. The latest NAV of the company was $0.92 so at face value, we cannot say it was taken out at a cheap price. But, considering that rent is skyrocketing in sunny Singapore as a result of global inflation and further considering the stock's IPO price was $1 back in 2013 and the current cap rate (4.5-6%) of its five properties are pretty, which means it is not expensive (see pic below), well, I guess we have to admit Ong Beng Seng got the better bargain.

It is very difficult to have win-win transactions in life. Some people live through their lives believing it doesn't exist. Someone has to win and the other party has to lose. While that is not true, it might be so in this case. We, as minority shareholders, did not get our fair exit, with the backdrop of the current worldly state of affairs. Firstly, inflation rate is spiking and we know that properties are one of the best asset classes to own during an inflationary environment. Secondly, we all know that rents in Singapore are going through the roof, so we should see property prices soaring.

Lastly, Paragon, the iconic Orchard property, valued at SGD2.6bn, cap rate of 4.5% seemed to be at a discount. Pre-covid, it was valued closer to SGD2.8bn. Coincidentally, the market cap of SPH Reit is also at the takeover market cap of SGD2.6bn, which means that the rest of the properties come free. Of course that is simplistic because we did not take into the account of the debt. If we do that, then we come back to the NAV of $0.92 which, gut-feel wise, also seemed cheap.

So, are minority shareholders being short-changed?

The short answer, I would say is yes. But as a long term shareholder though, I have also benefited from collecting the c.5% dividend over the last 9 years. So this meant that I have collected 45% of my capital or c.$0.40-$0.44 which meant that I still made a decent profit selling to Ong Beng Seng at $0.9372 considering the dividend gains. It is said that more than half of long term investing gains come from dividends and in this case, that is arguably true.

Unfortunately, for recent buyers, they might be taken out at a cheap price and there is really no good way to fight back. Perhaps Singapore needs to see its share of activist investors who can fight for minority rights and stop corporate raiders from taking listed companies out cheaply.

For interested readers, you can also read about CK Tang

Hi Sir, does it mean that from 1 July 2022 (Friday) onwards SPH REIT will be delisted? I thought that it still depends on whether Cuscaden reaches the 90% minimum control before they can apply for delisting the REIT? My wife is still holding on to SPH REIT currently.

ReplyDeleteSPH reit is still trading today

ReplyDeleteI believe the offer ends on 30 June but it does not necessarily mean SPH REIT is privatised or stopped trading.

ReplyDeletewhat a spread of misinformation !

ReplyDelete